STMicroelectronics, a leading global semiconductor company, has announced its financial results for the second quarter of 2024. Despite a challenging market environment, the company continues to deliver strong revenues across multiple business segments. However, macroeconomic conditions and shifting demands in key sectors like automotive and consumer electronics have impacted profitability. Below is a detailed breakdown of their financial performance.

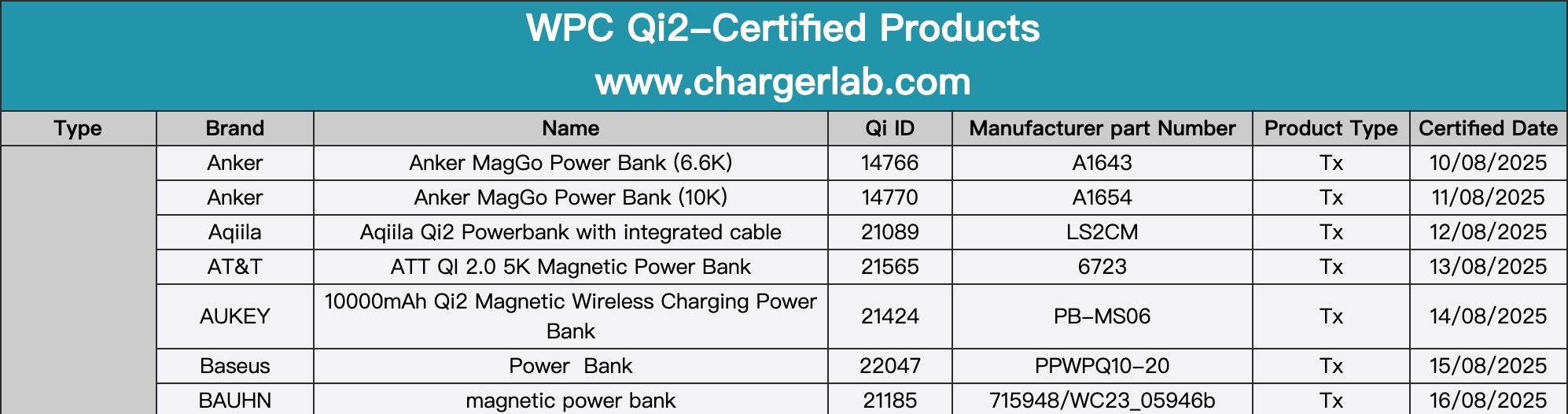

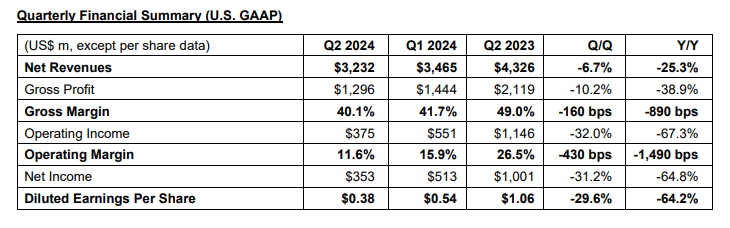

Net Revenue: $3.23 billion, a decrease of 25.3% year-over-year.

Gross Margin: 40.1%, down from 49.0% in Q2 2023.

Operating Income: $375 million, a sharp decline of 67.3% compared to Q2 2023.

Operating Margin: 11.6%, compared to 26.5% in the same quarter last year.

Net Income: $353 million, a drop of 64.8% from $1 billion in Q2 2023.

Earnings per Share (Diluted): $0.38, down from $1.06 in the previous year.

Net Revenue: $6.70 billion for the first half, with a gross margin of 40.9%.

Operating Margin: 13.8%, and Net Income: $865 million, down from $2.05 billion in H1 2023.

Analog, MEMS & Sensors Division: Revenue decreased by 10.0%, with an operating margin of 12.4%.

Power & Discrete Division: Revenue fell by 24.4%, and the operating margin dropped to 14.7%.

Microcontroller Division: Experienced a significant revenue decline of 46.0%, with an 8.9% operating margin.

Operating Cash Flow: $702 million for the quarter, down from $1.31 billion in Q2 2023.

Capital Expenditure: $546 million, reflecting continued investment despite reduced spending compared to last year.

Free Cash Flow: $159 million, compared to $209 million in Q2 2023.

Expected Net Revenue: $3.25 billion.

Gross Margin: Projected around 38%, reflecting increased idle capacity costs.

STMicroelectronics remains focused on managing costs while preparing for gradual improvements in market demand in the upcoming quarters.

Warm reminder: The above information is for reference only and not as market entry advice; investment is risky and caution is required when entering the market.