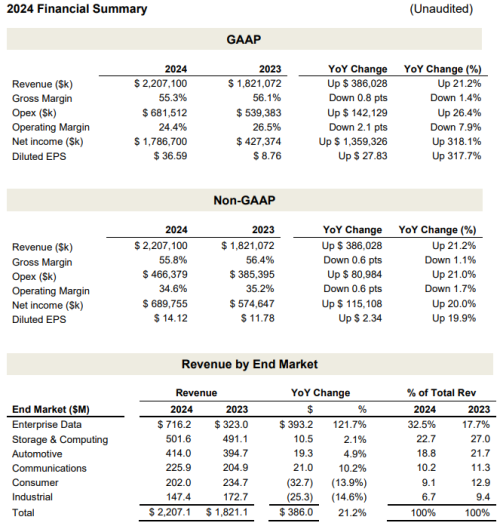

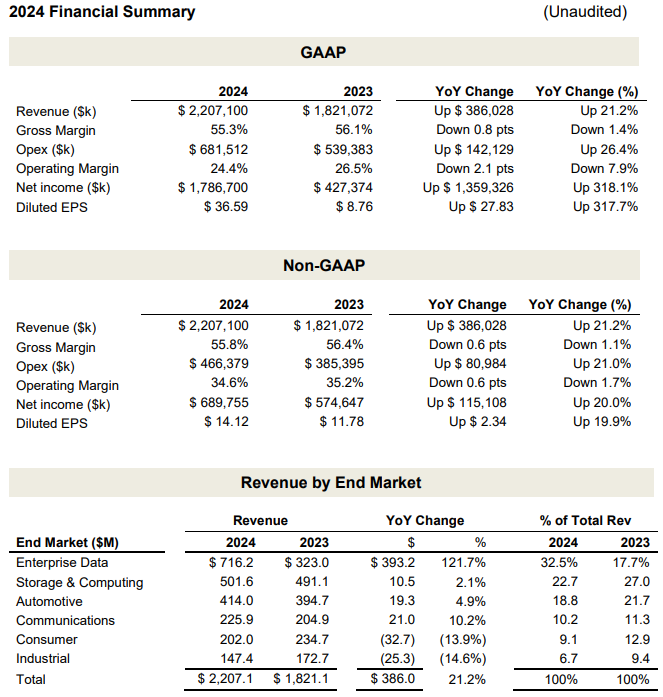

Full Year 2024 Highlights

Revenue: $2,207.1 million, up 21.2% YoY.

GAAP Net Income: $1,786.7 million, surged 318.1% YoY, driven by a one-time tax benefit.

Non-GAAP Net Income: $689.8 million, up 20.0% YoY.

Diluted EPS: GAAP EPS rose to 36.59(+317.7% YoY)

Key Growth Drivers: Enterprise Data revenue soared 121.7% YoY to $716.2 million, fueled by AI and server solutions.

Q4 2024 Highlights

Revenue: $621.7 million, up 36.9% YoY and 0.2% QoQ.

GAAP Net Income: $1,449.4 million (+1,395.7% YoY), including a significant tax benefit.

Non-GAAP Net Income: $198.4 million, up 40.9% YoY but down 0.2% QoQ.

Diluted EPS: GAAP EPS jumped to 29.88(+1,409.1

29.88(+1,409.14.09 (+42.0% YoY).

Segment Performance:

Enterprise Data: $194.9 million (+51.2% YoY, 31.3% of total revenue).

Automotive: $128.4 million (+43.0% YoY, 20.6% of total revenue).

Balance Sheet & Capital Allocation

Cash & Equivalents: 862.9𝑚𝑖𝑙𝑙𝑖𝑜𝑛𝑎𝑡𝑄4’24𝑒𝑛𝑑,𝑑𝑜𝑤𝑛𝑓𝑟𝑜𝑚

862.9millionatQ4’24end,downfrom1.46 billion in Q3’24, primarily due to $622 million share repurchases in Q4.

Dividend Increase: Quarterly dividend raised 25% to $1.56 per share.

New Buyback Program: $500 million authorized over three years.

Q1 2025 Outlook

Revenue Guidance: $610–630 million.

Non-GAAP Gross Margin: Forecasted at 55.4%–56.0%.

Non-GAAP Operating Expenses: Expected between $126.9–130.9 million.

MPS continues to leverage innovation in power solutions across high-growth sectors, maintaining its 13th consecutive year of revenue growth.

Warm reminder: The above information is for reference only and not as market entry advice; investment is risky and caution is required when entering the market.