Introduction

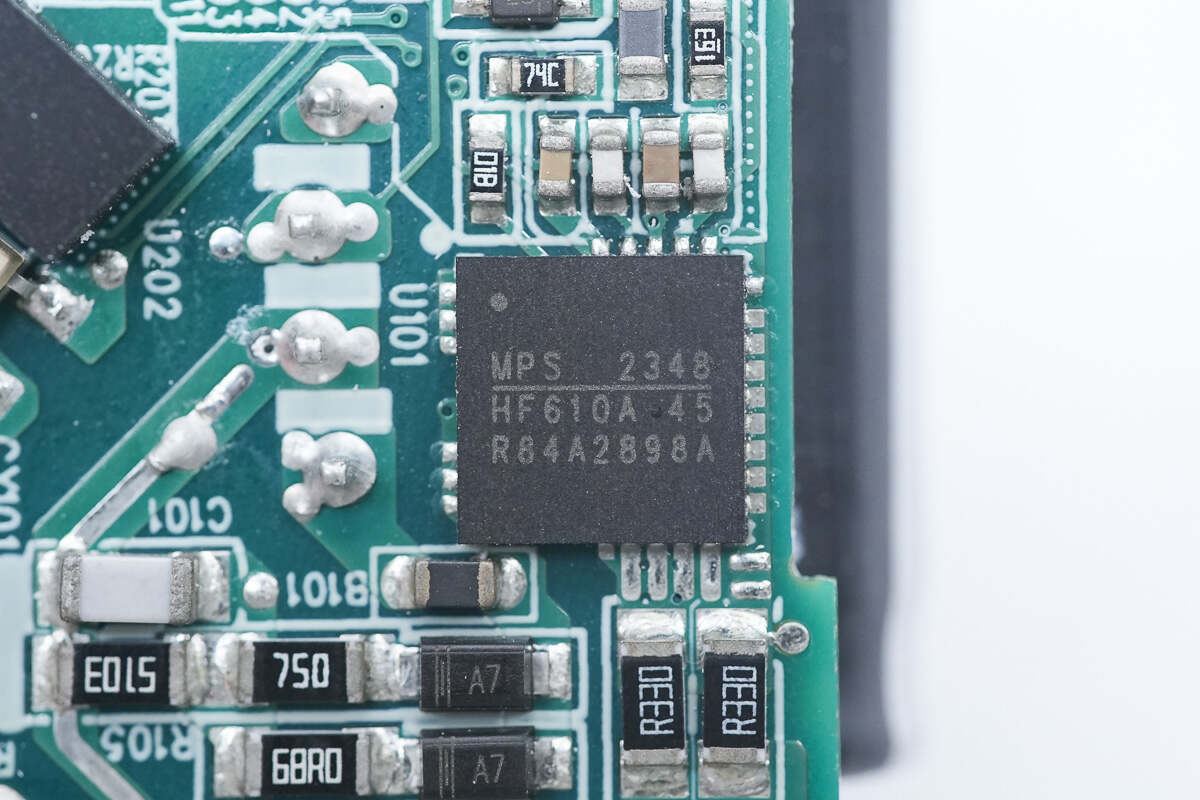

Monolithic Power Systems, Inc. (Nasdaq: MPWR), a leading fabless global company specializing in high-performance, semiconductor-based power electronics solutions, announced its financial results for the second quarter ended June 30, 2024.

Financial Data of MPS

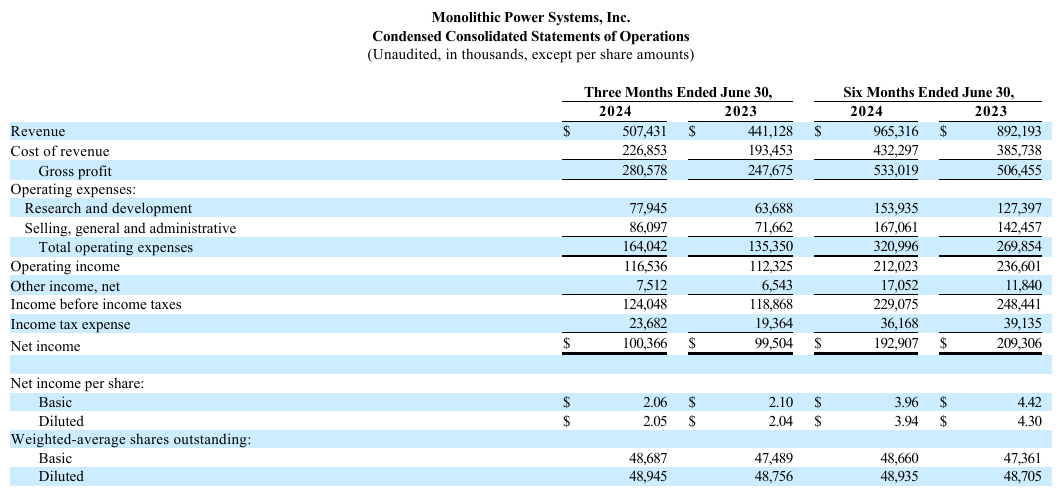

In the second quarter, the company achieved significant growth. Revenue for the quarter reached $507.4 million, representing a 10.8% increase from $457.9 million in the previous quarter and a 15.0% increase from $441.1 million in the same quarter of the previous year.

The company's gross margin performance was as follows: GAAP gross margin was 55.3% for the quarter ended June 30, 2024, compared with 56.1% in the same quarter of the previous year. Non-GAAP gross margin, excluding certain expenses, was 55.7% for the same period.

Operating expenses showed some changes. GAAP operating expenses were $164.0 million for the quarter ended June 30, 2024, compared with $135.4 million in the corresponding quarter of the previous year. Non-GAAP operating expenses, after excluding specific items, were $111.7 million.

The company reported strong operating income. GAAP operating income was $116.5 million for the quarter, compared with $112.3 million in the second quarter of 2023. Non-GAAP operating income, excluding certain costs, was $171.0 million.

In terms of net income, GAAP net income was $100.4 million and $2.05 per diluted share for the quarter ended June 30, 2024. In comparison, GAAP net income was $99.5 million and $2.04 per diluted share in the same quarter of the previous year. Non-GAAP net income, after adjusting for certain factors, was $155.1 million and $3.17 per diluted share.

Looking at the six months ended June 30, 2024, revenue amounted to $965.3 million, an 8.2% increase from $892.2 million in the same period of the previous year. GAAP gross margin was 55.2%, compared with 56.8% in the prior-year period. Non-GAAP gross margin, excluding certain impacts, was 55.7%.

GAAP operating income for the six months was $212.0 million, compared with $236.6 million in the first half of 2023. Non-GAAP operating income, after exclusions, was $322.6 million.

GAAP net income for the six-month period was $192.9 million and $3.94 per diluted share, while in the same period of the previous year, it was $209.3 million and $4.30 per diluted share. Non-GAAP net income, after adjustments, was $292.6 million and $5.98 per diluted share.

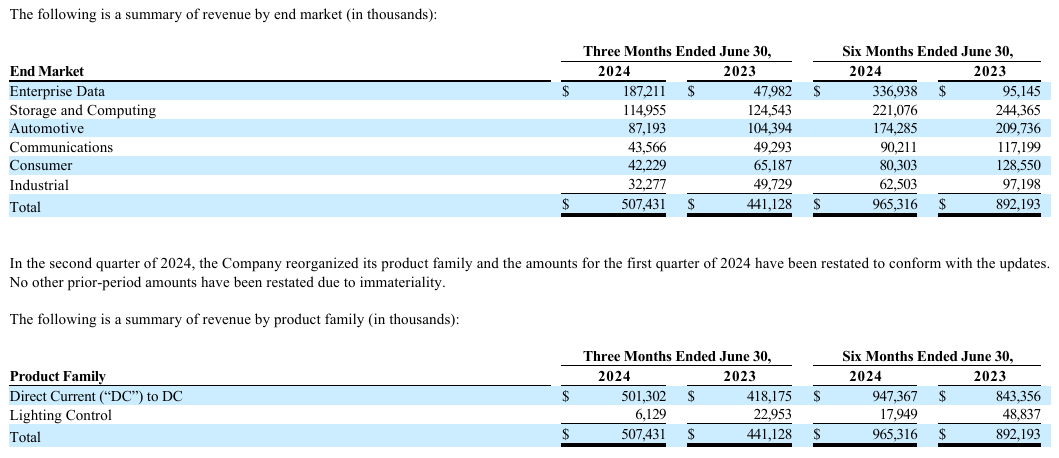

By end market, the revenue breakdown for the three months ended June 30, 2024 was as follows: Enterprise Data generated $187,211; Storage and Computing contributed $114,955; Automotive brought in $87,193; Communications had $43,566; Consumer accounted for $42,229; and Industrial was $32,277.

By product family, for the same period, Direct Current ("DC") to DC had revenue of $501,302, and Lighting Control had $6,129.

Summary of ChargerLAB

Looking ahead to the third quarter ending September 30, 2024, MPS provided the following financial targets: Revenue is expected to be in the range of $590.0 million to $610.0 million. The company's CEO, Michael Hsing, stated, "As we have emphasized for many years, our results reflect the continued success of our proven, long-term growth strategy and our transformation from being only a chip supplier to a full solutions provider."

In conclusion, Monolithic Power Systems has demonstrated solid financial performance in the second quarter of 2024 and is optimistic about its future prospects, as reflected in its business outlook for the third quarter.

Warm reminder: The above information is for reference only and not as market entry advice; investment is risky and caution is required when entering the market.